With the rise of digital technology, global cross-border information flows are driving significant growth in international digital commerce. This paper employs Meta-analysis to examine the impact of cross-border information flows on global trade competitiveness. It outlines the Meta-analysis paradigm, explores the relationship between data element valorization and trade competitiveness, and highlights the varying effects across different stages of the trade process. Using correlation coefficients as effect values, the study transforms and calculates data with the help of formulas and software to comprehensively analyze and test the relationship. The findings reveal rapid growth in China’s digital economy, expanding from 22.6 trillion yuan in 2016 to 51.9 trillion yuan in 2022, deeply influencing industrial structures. In global cross-border data flows, China and Russia exhibit tighter regulations, with China’s DSTRI value rising from 0.325 to 0.347 million USD, demonstrating that cross-border data flows significantly impact global trade competitiveness.

For the last few years, in the environment of economic digitization, globalize digital trade has rapidly emerged, greatly changing the traditional international trade system and the mode of globalize value chain department of labor [1]. Most serious in the post epidemic period, numeric commerce, as a new form of international commerce, has injected a strong impetus for the recovery of the world economics. Astride nationality information circulate as the basic support of digital commerce, and its related regulation has become a key topic of global digital trade governance [21,4,6]. According to the World Trade Organization’s trade data, by 2030, digital technology will increase the volume of global trade by about two percent per year, and the share of global trade in services will be increased to twenty-five percent [17]. The pattern of global trade competition has gradually presented a new situation centered on astride nationality information circulate, and all major economies have been striving to obtain the dominant power in cross-border data flow rulemaking, trying to build a system that suits their own interests [16]. Cross-border data flows are different from traditional trade in goods, and the supervise of astride nationality information circulates in various countries has different needs due to the distinction in the standard of progress of digital technology.

This paper summarizes the current status of study on the influence of astride nationality information circulate on international commerce competitiveness, points out the drawback of the present study, and provides theoretical foundations and background support for this study. At the same time, this paper utilizes the Meta-analysis paradigm to comprehensively explore the role of cross-border data flow on international trade competitiveness, and puts forward and tests the relevant hypotheses under the control of macroeconomic variables. Moreover, it deeply analyzes how data elements flowing across borders can be reorganized and reallocated in the globalize worth link to accelerate the capitalization and valorization of data, so as to enhance the competitiveness of international trade. This study reveals the key role of astride nationality information circulates in the global economics and its long-term impact on the international trade pattern. Subsequently, with the help of CMA3.0 software, the correlation coefficients of astride nationality information circulate and cosmopolitan commerce competitiveness are calculated through Fisher’s transformation, the processing effect values are weighted and averaged to ensure that the variable relationships can be presented in a holistic manner, and finally, the comprehensive effect values are obtained through inverse transformation to analyze the relationship between the two accurately.

Zhong, et al. [22] analyzed the interaction system between astride nationality electronic commerce and cosmopolitan commerce and constructed a pattern to reveal the promotion result of cosmopolitan commerce on astride nationality electronic commerce. Based on the data of Ningbo City, the VAR model verified the active impact of cosmopolitan commerce on astride nationality electronic commerce. Accordingly, administration and company strategy suggestions to accelerate the ideal quality progress of astride nationality electronic commerce are put forward. Jiang, [7] argues that Beijing seeks a greater role in the international order by focusing on the security, order and progress of astride nationality information governance. Despite data policy constraints, China demonstrates flexibility and openness to participate in international initiatives. Beijing advocates that cyberspace is a non-competitive domain and should promote the common interests of developing countries. Ma, et al. [12] based on Wish merchant data, found that astride nationality electronic commerce export performance is affected by element for example enterprise tenure, platform competition and other factors in an inverted U-shape trend, with moderate competition extending the life cycle, and high-quality services, diversified products, and low prices boosting export performance. Li, [10] Under the development of electronic commerce, China’s foreign commerce has Huge change, online shoppers are the most in the world. FTZ and cross-border e-commerce linkage promotes foreign trade, and the FTZ model is upgraded. The study reveals the linkage effect of the two, integrates trade channels, and improves demand, product added value and market efficiency. Yin, et al. [20] study analyzes the influence of China’s astride nationality electronic commerce on the goods are sold abroad the Belt and Road nation from 2000 to 2018 with a gravity pattern, and finds that it has a greater active influence on commerce in services than on commerce in freights, and that with the improvement of the standard of electronic commerce, the distance has weakened the influence on commerce in services, and its commerce in freights The influence changes year by year. Accelerate the progress of astride nationality electronic commerce can increase the volume of exports. Kim, et al. [9] study utilized new data from CAREC to assess the impact of reducing the cost of time at border crossings on commerce. The consequence show that a 10% reduction in inbound time can enhance commerce by 1-2% and the impact is higher than outbound. The more severe the time bottleneck, the greater the impact, and the effect has been more important for the last few years, emphasizing the importance of trade facilitation. Yang, et al. [19] focus on the influence of astride nationality electronic commerce system service function and electronic commerce link firms’ numeric switch function on firms’ manifestation in a digital trade ecosystem. Digital platform service capability was found to affect performance through provision relation and degression command, and numeric switch capability played a mediating role in this process. Both significantly enhance firm performance, suggesting that numeric system service optimization and firm numeric switch are crucial for driving the sustained growth of digital trade in China. Cui, et al. [5] construct astride nationality supply chain element frame on the basis of synergy theory, and evaluate its impact by combining fuzzy set and DEMATEL methods. The study shows that although information sharing and profit sharing are traditional drivers, they are non-core in the national policy context. High level control and customs supervise become key drivers. Practitioners need to pay attention to senior manager and customs support, and improve information sharing and trust to indirectly accelerate the progress of astride nationality supply chain cooperation and adapt to the global impact of “The national policy Initiative”. Wu, et al. [18] construct indicators of numeric commerce rules in PTAs and use gravity modeling to analyze their facilitating effect on services trade in global value chains. The consequence show that the depth and scope of numeric commerce rules significantly promote service exports, especially for future service exports. Meanwhile, this result is influenced by income standard, PTA type and distinctions in regulatory quality among nation. The dynamic model further reveals that there is a dual effect of anticipation and gradual implementation of numeric commerce rules on the promotion of services trade, which provides an important reference for optimizing services trade in GVCs.

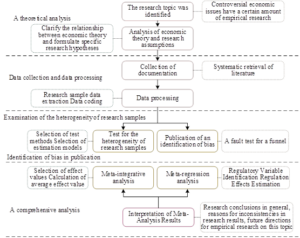

Meta-analysis of astride nationality information flow as shown in Figure 1, this paper is based on the specific use of Meta-analysis method in the field of astride nationality information circulate, from the literature obtained from the search to screen out the literature related to astride nationality information flow that meets the criteria as a sample of the study, and to extract the data required for the analysis from Meta. The heterogeneity of the research samples in terms of astride nationality information circulate is tested, and then Meta is integrated and analyzed, and the results of the Meta analysis are finally interpreted.

Before conducting a meta-analysis of astride nationality information circulates, it is important to clarify the economic issues to be explored and to establish the theme and objectives of the study. Given that Meta-analysis is based on the consideration of statistical bias caused by human factors, and can more accurately analyze the relationship between economic theories, this method is suitable for those issues that have important research value, but the conclusions of previous empirical studies are inconsistent, especially controversial. Therefore, when Meta-analysis is carried out in the economics of astride nationality information circulate, controversial theoretical issues should be selected as the subject of the study, so as to ensure the rationality of the selection of the research method in the study of astride nationality information circulate, and to fully demonstrate the value of this method [2,11,23]. In addition, there should be a large number of empirical studies on the economic theory of astride nationality information flow, and the effect values of these empirical studies can be obtained and are comparable, so as to ensure the prerequisites for the use of Meta-analysis.

Meta-analysis is necessary to identify and clarify the relationships between economic variables related to astride nationality information circulates, and in order to model these relationships more realistically, the impact of the economic variable of astride nationality information circulates on the economic variable of international trade competitiveness is explored while controlling for some of the influencing variables. For example, in analyzing whether astride nationality information circulates have an impact on cosmopolitan commerce competitiveness, macroeconomic conditions that are bound to have an effect on international trade competitiveness are taken into account. For example, the degree of trade openness, the standard of technological innovation, the size of the market and so on are used as control variables, based on which the influence of astride nationality information circulate variables on the variable of international commerce competitiveness is investigated [8,15,14]. In the process of Meta-analysis, it is necessary to qualitatively analyze based on specific and astride nationality information circulate, and summarize the expression for the estimation of the relationship between economic variables as: \[\label{GrindEQ__1_} Y_{i} =\alpha +\beta X_{i} +\gamma C_{i} +\mu _{i} , \tag{1}\] where \(i\) is used to represent the study individual, \(Y_{i}\) represents the dependent variable in the relationship of the economic variable of international trade competitiveness, \(X_{i}\) represents the independent variable of cross-border data flow, \(C_{i}\) represents the vector of moderating variables in the relevant variable, \(\alpha\) represents the constant term, \(\beta\) represents the vector of coefficients of the independent variable, \(\gamma\) represents the vector of coefficients of the control variable, and \(\mu\) represents the residual term.

Through the Formula (1) can see astride nationality information circulate and cosmopolitan commerce competitiveness, the basic form of the relationship between this economic variable. At the same time, it can also be seen that cross-border data flow, the independent variable \(X_{i}\) on international trade competitiveness, the direction of the influence of the dependent variable \(Y_{i}\), based on which the research hypothesis on the relationship between cross-border data flow and international trade competitiveness can be put forward. Similarly, from the overview of other moderating factors affecting the relationship between cross-border data flows and international trade competitiveness, it is possible to formulate research hypotheses concerning the impact of these moderating factors on the relationship between this economic variable. For example, in analyzing the issue of cross-border data flows and international trade competitiveness, through the theoretical overview of the basic relationship between cross-border data flows and international trade competitiveness, the research hypothesis that the overall estimation results of empirical studies on the relationship between cross-border data flows and international trade competitiveness should be positively correlated is proposed. A number of research hypotheses on the impact of moderators on the effects of economic variables on the relationship are also proposed, based on the moderators affecting the cross-border data flow-international trade competitiveness relationship.

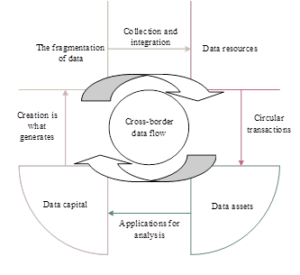

The process of information capital value creation is closely linked to the circulate of information elements in various cosmopolitan commerce production links. Cross-border flows promote the reorganization and reallocation of data capital globally, thus building a globalize information worth link in the cosmopolitan production department of labor system [3]. The globalize information worth link relies on the digitalization of the economy to achieve the physical separation of the data collection, transmission, analysis and application processes, so that the information elements can form a worth cycle through astride nationality flows around the world, thus building a globalize information worth link. This is similar to the essence of traditional worth links, which is the transnational circulate of element of production, while the essence of information worth chains lies in the transnational circulate of information, a new type of element of production. Multinational enterprises, as micro actors, build globalize information worth chains through the collection, integration, analysis and application of information from all over the world, and optimize provision links, production and R&D, and after-sales services in the form of digitalization. According to the digital principle, the rate of numeric globalize is on the basis of the geometric growth of astride nationality information flow. Through astride nationality information circulate, many data can be resourced, assetized and capitalized globally, promoting the evolution of data factor valorization while building a global data value chain.

Figure 2 shows the mechanism of evolution under cross-border data flow, where different countries or regions have different advantages in data collection and production in the process of cross-border flow from fragmented data to data resources. Some countries take the lead in data collection equipment, sensor technology or data collection infrastructure, while others are more competitive in data generation and production in specific industries or fields. These fragmented data and their processed factor resources flow globally and constitute the upstream link that affects the competitiveness of international trade.

In the process of astride nationality flows from data resources to data assets, data are processed, analysed and exchanged in circulation, and transferred to trade subjects that are better able to realize their potential value. Some countries have advanced technology and expertise in areas such as big data, artificial intelligence or machine learning, while others have an advantage in industry-specific data analysis and application. Diverse data assets rely on the data factor market to continuously circulate and trade globally, forming an intermediate link that affects the competitiveness of international trade [13].

In the process of astride nationality circulate from data assets to data capital, the multi-scenario application of data elements is the key to realizing the value of data and enhancing the competitiveness of international trade. Different countries have different market and consumer needs and differentiated business models in data application and innovation. Some countries are leading the way in data-driven business modeling, digital product or service innovation, and continue to unleash the commercial value of data capital through multiple applications. Data capital flows globally, forming a downstream link that affects the competitiveness of international trade.

It can be seen that the impact of astride nationality information circulates on the competitiveness of international trade is not only reflected within a country’s borders, but also runs through the process of astride nationality information flows and the growth of the numeric economics under the global information value chain. For the process of information resourcing, transnational digital platforms can collect fragmented data created by consumers or enterprises in different countries, and process and condense them into data resources with the help of digital technology, but this also triggers data security, resource monopoly, digital divide and other problems that need to be solved, which in turn affects the competitiveness of international commerce. For the process of data assetization, the data contained in digital trade can be used as trade products and services to participate in global trade, circulate to all participating subjects and integrate into the production process to create value. With the continuous improvement of astride nationality information circulate, data rights rules, data security agreements and other systems, the role of data assets in enhancing the competitiveness of international trade will be more significant. For the process of data capitalization, on the one hand, data capitalization in digital trade is manifested in the optimization of marketing and business strategies through numeric technologies for example big information, cloud computing, etc., the development of high-value-added products and services by using digital technologies for example artificial intelligence, block link, etc., and the digitization of related industries through the fusion of traditional industries, such as online entertainment, online education, etc., so as to enhance the competitiveness of international trade. On the other hand, data capital uses digital platforms as a medium to continuously innovate trade methods, optimize trade processes, and create new business models driven by data elements. Cross-border platforms such as e-commerce platforms, online sharing platforms, financial technology platforms, online social network service platforms, etc. provide a broad space for digital service commerce, numeric product commerce, numeric technology commerce, etc. And in the process of numeric commerce, new fragmented data are constantly generated, realizing the positive feedback loop of data value utilization, ultimately forming a global data value chain and affecting the competitiveness of international trade.

The correlation coefficients are treated as effect values to explore the correlation between astride nationality information circulate and cosmopolitan commerce competitiveness, using CMA 3.0 software, the correlation coefficients of astride nationality information circulate and cosmopolitan commerce competitiveness are selected as statistical quantities, and the transformed correlation coefficients are treated as composite effect values obtained through the Fisher transformation, and then the final effect test is carried out. The composite effect value does not depend on one study alone, but shows the relationship between variables in general. First, the extracted correlation coefficients are Fisher transformed so that they conform to an asymptotic normal distribution. The formula is given below: \[\label{GrindEQ__2_} Z=0.5\times 1n\frac{\left(1+r\right)}{\left(1-r\right)} . \tag{2}\]

In Eq. (2), \(r\) describes the correlation coefficient and \(Z\) describes the transformed Fisher \(Z\) value.

Next, the \(Z\) values were weighted and averaged to treat them in such a way that the proportion of the individual effect value in the overall effect value was the same as the proportion of that sample in the total sample. The formula is as follows: \[\label{GrindEQ__3_} \bar{{\rm Z} }=\frac{\sum \left(n_{i} -3\right){\rm Z} _{i} }{\sum \left(n_{i} -3\right) } . \tag{3}\]

Rationalizing the standard error \(SEE\) and the corresponding effector weights \(W_{i}\), the expression is: \[\label{GrindEQ__4_} SEE=\frac{1}{\sqrt{n-3} } , \tag{4}\] \[\label{GrindEQ__5_} W_{i} =\frac{1}{SEE^{2} } . \tag{5}\]

Finally, the inverse transformation translates into a correlation coefficient of \(\bar{r}\) for the final effect value, with the operational equation: \[\label{GrindEQ__6_} \bar{r}=\frac{e^{2\bar{{\rm Z} }} -1}{e^{2\bar{{\rm Z} }} +1} . \tag{6}\]

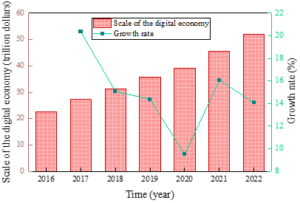

The digital economics has long been an important part of China’s economic system, and it is the core force of economic progress in the new situation. The scale and increase speed of China’s numeric economy from 2016 to 2022 are shown in Figure 3.The scale of China’s numeric economics reached 22.6 trillion yuan in 2016, which served as the starting point of the period, showing that the digital economy had already had a considerable scale. In the following years, the size of the digital economy climbed year by year, especially between 2018 and 2020, with a particularly significant growth rate. By 2022, the scale of the numeric economics has jumped to 51.9 trillion yuan, indicating that the weight and influence of the numeric economics in China’s economics has been increasing. Starting in 2017, the digital economy has grown rapidly. Between 2017 and 2019, the growth rate fluctuated, but generally maintained an upward trend, especially in 2019, when it reached a level of 14.38%. Entering 2020, China’s digital economy maintained strong growth momentum, with growth rate stabilizing at around 15%, despite the challenges of global epidemics and other unfavorable factors. By 2021, the growth rate declines slightly but remains at a high level of 16.07%, demonstrating the strong resilience and growth potential of the numeric economics. By 2022, the growth rate of the numeric economics slows down further, which is related to factors such as the base effect, economic structural transformation and policy adjustment. However, this does not mean that the digital economy has stopped growing, but rather indicates that its growth model is undergoing a transformation, focusing more on the improvement of quality and efficiency.

In the past, the physical marketing of international trade export enterprises with the help of astride nationality information flow and related digital technology, transferred to the network to carry out nearly zero-cost online sales, so as to make the enterprise products free from the constraints of the traditional sales model. In the context of astride nationality information circulate, international trade export enterprises apply digital technology, can break through the space-time limitations, through the network channel will be sold all over the world, and then comprehensively enhance their own influence in the international and competitive advantage in the market. Table 1 shows the penetration rate of the progress of the numeric economics to the three major industries, the value added of China’s numeric economics from 2020 to 2023, the proportion of GDP, and the penetration rate to different industries. Among them, the primary industry is agriculture, the secondary industry is industry, and the secondary industry is service industry.

The growth from $39.2 trillion in 2020 to $51.7 trillion in 2023 shows that the digital economy has achieved remarkable growth in just four years. Meanwhile, the digital economy’s share of GDP has also increased from 32.8% in 2020 to 38.9% in 2023, indicating that the numeric economics has become increasingly important in China’s economy and has become one of the key factors driving economic growth. The penetration rate to the primary industry grows from 6.6% in 2020 to 9.4% in 2023, which is a relatively slower growth rate but reflects that the application of digital technology in agricultural modernization and precision agriculture is gradually deepening. The penetration rate to the secondary industry grows from 17.1% in 2020 to 19.5% in 2023, showing the wide application and rapid development of digital technology in manufacturing, industrial automation, smart manufacturing and other fields. The penetration rate to the tertiary industry grows most significantly, jumping from 32.6% in 2020 to 48.1% in 2023. This indicates that the numeric economics has the highest degree of integration and application in the service industry, which greatly facilitates the digital switch and upgrading of the service industry.

| Year | Value-added (trillion) | Penetration rate of primary industry (%) | Penetration rate of primary industry (%) | Penetration rate of secondary industry (%) | Penetration rate of tertiary industry (%) |

| 2020 | 39.2 | 32.8 | 6.6 | 17.1 | 32.6 |

| 2021 | 45.5 | 34.1 | 7.4 | 18.2 | 35.8 |

| 2022 | 50.2 | 36.4 | 8.2 | 18.6 | 47.6 |

| 2023 | 51.7 | 38.9 | 9.4 | 19.5 | 48.1 |

Based on the DTRI and DSTRI scores of each major economy, this paper screens out the sub-indicators related to data cross-border flow restrictions, identifies the EU, Russia, India, China, the United States and Singapore as the representative economies, and conducts a comparative analysis of the degree of restriction on astride nationality flow of information in each country, Table 2 shows the degree of restriction on astride nationality flow of information measured by the DTRI, and the degree of restriction on data astride nationality flow of China and Russia is relatively high, with 0.82 and 0.63 respectively. Table 2 shows the degree of restriction of information astride nationality circulate measured by the DTRI, China and Russia have relatively high degrees of data cross-border regulation, respectively 0.82 and 0.63, followed by India, Singapore and the EU, and the U.S. has the lowest degree of restriction of 0.15. China and Russia are still among the two countries with the highest scores, which indicates that the two countries are relatively more stringent in cross-border regulation of data, followed by India, and the U.S. at the bottom of the list. In terms of trends, China, Russia, and India have progressively strengthened their cross-border data regulation policies, while the U.S. has not implemented more prominent restrictions on astride nationality information transfers in this time period.

| Country | Digital trade restriction index |

| China | 0.82 |

| Russia | 0.63 |

| India | 0.31 |

| Singapore | 0.25 |

| European Union | 0.24 |

| United States of America | 0.15 |

The degree of restrictiveness of data cross-border flows as measured by the DSTR is shown in Table 3, and the value of the indicator of the degree of restrictiveness of data cross-border flows in the United States remains constant at $0.062 million throughout the observation period 2016-2022, without any change. This suggests that the U.S. data cross-border flow policy is relatively stable, or that the indicator is not sensitive for the U.S., or that the DSTR system has limited applicability in the U.S. The degree of restriction on data astride nationality circulates in China increases slightly from $0.325 million in 2016 to $0.347 million in 2022. This suggests that China may have increased regulation or restrictions on the astride nationality circulate of information, possibly due to data protection, national security, or economic interests. India’s level of restriction on astride nationality flow of information was relatively stable between 2016 and 2018, but increased in subsequent years. The increase from $0.141 million in 2016 to $0.225 million in 2022 suggests that India’s policies on astride nationality information flows may also be gradually tightening. Similar to China and India, the extent of restrictions on astride nationality flow of information in Russia is also increasing year on year. The increase from USD 0.22 mln in 2016 to USD 0.304 mln in 2022 shows that Russia is also tightening its supervises on astride nationality circulates of information.

| Year | United States (millions of dollars) | China (millions of dollars) | India (millions of dollars) | Russia (millions of dollars) |

| 2016 | 0.062 | 0.325 | 0.141 | 0.22 |

| 2017 | 0.062 | 0.325 | 0.141 | 0.26 |

| 2018 | 0.062 | 0.347 | 0.185 | 0.26 |

| 2019 | 0.062 | 0.347 | 0.185 | 0.282 |

| 2020 | 0.062 | 0.347 | 0.225 | 0.282 |

| 2021 | 0.062 | 0.347 | 0.225 | 0.282 |

| 2022 | 0.062 | 0.347 | 0.225 | 0.304 |

This paper uses Meta-analysis to explore the impact of astride nationality information flow on cosmopolitan commerce competitiveness. The method of correlation between astride nationality information flow and cosmopolitan commerce competitiveness achieves an in-depth study of the relationship between astride nationality data flow and cosmopolitan commerce competitiveness. The analysis finds that the scale of China’s numeric economics grows from 22.6 trillion yuan in 2016 to 51.9 trillion yuan in 2022, and the growth rate increases in general after 2017, with significant growth in 2018-2020, and the growth rate in 2022 slows down but the growth pattern pays more attention to the enhancement of quality and efficiency. The penetration rate of the numeric economics into China’s three major industries has been increasing, with the penetration rate into the tertiary industry surging from 32.6% in 2020 to 48.1% in 2023, the most significant growth. Penetration of the secondary industry grows steadily from 17.1% in 2020 to 19.5% in 2023, while penetration of the primary industry grows from 6.6% in 2020 to 9.4% in 2023, relatively slow but still with room for improvement. The influence of cross-border data flows on cosmopolitan commerce competitiveness runs through the process of astride nationality information circulates under the global information worth link and the growth of the numeric economics, and the development of the numeric economics as well as the regulatory policies on astride nationality information circulates have an important influence on international commerce competitiveness.